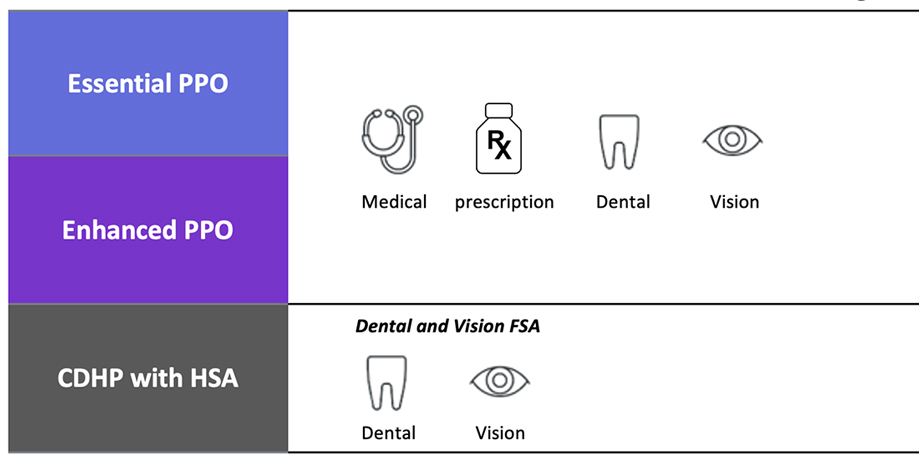

You may save $3,300 in pre-tax contributions for qualifying healthcare expenses. If you’re enrolled in the United CDHP with HSA or Kaiser CDHP with HSA, you can contribute pre-tax money to a Dental and Vision FSA. It works like the Healthcare FSA, but you can only use it for qualified dental and vision expenses. The total amount you elect to save for the plan year is available on January 1. However, you must use-it-or-lose-it. There is no rollover feature with an FSA.

Check out FSAstore.com to browse an online store full of products that qualify as eligible expenses.

Save money to cover child and elder care expenses through convenient pre-tax payroll contributions throughout the year.

You can make pre-tax contributions to a special savings account that you can use to pay for preschool, summer day camp, before or after school programs, and eligible child or elder care. We call it the Dependent Daycare FSA. You may save up to $7,5001 and you must use 100% of the money you save before the IRS-required deadline, or you’ll forfeit any remaining balance.

One word of caution: Unlike the Healthcare FSA, you have to save money before using your account balance to pay for expenses. Until you get enough saved up to pay a bill, you’ll have to cover the cost out of pocket while saving pre-tax money in this account. Then you can reimburse yourself. If you’re concerned that this may be too difficult, this FSA may not be the savings vehicle for you.

Note for highly compensated employees (HCEs): The Internal Revenue Code (IRC) prohibits Dependent Daycare FSA plans from favoring HCEs. If you are deemed an HCE, your Dependent Daycare FSA election may be limited to a lower amount, and if the plan is found to discriminate against non-highly compensated employees, Asurion must further reduce your contributions to a level that enables compliance with the IRC. You will be notified with further details if there is any impact to you.

1Married individuals who file separate tax returns may each save $3,750.

Go to Asurion Benefits Central, click on Reimbursement Accounts, then click the Commuter Account option.

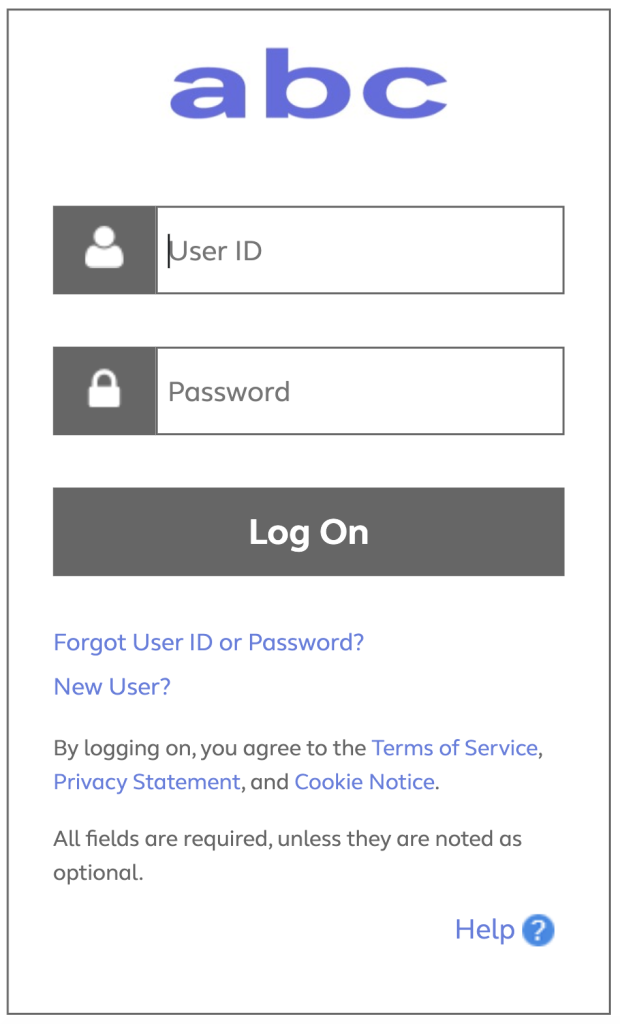

Heads up! You are leaving the ABC InfoShare. Unless you’re on the Asurion network, you’ll need your username and password to access Asurion Benefits Central at asurion.benefitsnow.com. Only current Asurion employees may log in.

If you don’t have the required log-in details, select Forgot User ID or Password? and follow the prompts. If this is your first visit to Asurion Benefits Central, click New User?

Questions: Call 844.968.6278.

Register in Asurion Learning for the meeting you’d like to attend. After registering, you’ll receive a confirmation email containing information about joining the meeting.

No events found.

Text “Benefits” to 67426 to have a link sent to your phone. Then, click the link to download the Alight Mobile app so you can access all the functions of the ABC on the go. (You’ll need to set your “Primary Phone” in Workday as your mobile number for full functionality.)