You must take action during this limited opportunity if you want:

When you’re ready, click “Enroll” in the top-right corner of this screen to elect your benefits on Asurion Benefits Central (“the ABC”).

The enrollment period is open November 4 – 18 and is the only window that benefit elections and changes will be accepted for 2026 without a qualifying life event.

Note: Benefits described here are effective January 1 through December 31, 2026. The ABC and Homebase are available through SSO to the Asurion network or by logging in with your username and password. No password is required to access the info share.

As healthcare costs continue to rise nationwide with double-digit healthcare inflation, we want to be transparent about how this affects your benefits and what we are doing to ensure we can continue to provide competitive benefits that remain financially sustainable for Asurion and our employees.

The vast majority of employees will have very minor premium adjustments – and many will have reductions. You need to visit the ABC to see if and how your coverage is affected. The changes we’re making for 2026 benefits are a large part of how we are working hard to keep increases manageable.

We’ve removed the complexity many of you expressed while choosing medical coverage by adopting a “meaningful choice” approach for 2026. This means our plans offer you the same comprehensive coverage, along with some enhancements.

Note: We have eliminated the Platinum Medical Option due to low participation.

Coverage through UnitedHealthcare

(Note: The UnitedHealthcare network includes 98% of providers our covered members see today.):

Coverage through Kaiser’s narrow network (available in six regions):

We’re moving from CVS Caremark to Optum for prescription coverage because Optum better integrates with our UnitedHealthcare medical plans. This does not apply to Kaiser’s integrated healthcare model. You’ll have only one ID card for your medical and prescription coverage. In addition, CDHP with HSA participants will enjoy expanded $0 generic preventive medications.

United Essential PPO and United Enhanced PPO participants will pay $150 copay per prescription for GLP-1s used for weight loss. CDHP participants will pay toward the plan’s deductible before coinsurance begins.

Compare plans and see more details about your medical coverage options.

Asurion is offering an exciting opportunity to reach your savings goals for qualifying healthcare expenses even faster through a new matching contribution. Asurion will match 50 cents for every $1 you contribute, up to $500 for individual coverage and up to $1,000 if you cover any dependent(s). Start earning the match with your first HSA contribution.

You may contribute up to $3,300 in pre-tax savings for medical, prescription, dental and vision expenses. (CDHP participants may use an FSA for dental and vision expenses only.) Unlike an HSA, the total amount you elect to contribute (for healthcare needs) is available at the beginning of the plan year. But, also unlike an HSA, the use-it-or-lose-it rule applies: you’ll forfeit any money you don’t spend on qualified purchases, so plan carefully.

You may contribute up to $7,500 for eligible child- or elder- care expenses. This is the first time since 1986 that the IRS has permanently raised the dependent daycare FSA limit!

Note: The limit is $3,750 per person for married couples who file separate taxes.

In simplifying our medical plan offerings, we carefully examined network data to find one that encompasses the vast majority of providers currently in use by Asurion employees today. By moving to the UnitedHealthcare broad network, you’ll experience:

Note: Kaiser’s narrow network is available in six regions.

Health Advocate services now include medical second opinions, replacing 2ndMD with the same level of expertise from board-certified professionals.

You retain flexibility to choose among three different levels of dental and vision coverage to help you meet your needs and budget, now through a single insurance carrier’s member-preferred network. The new plans also include some enhancements to coverage that were not previously available.

Another feature of our new plans is the option to pay $20 for Essential Medical Eye Care. This enhancement is available to you through any Asurion vision plan.

With Aura, you’ll have up to $5 million of protection, which is more than double the financial protection that’s available today through our current provider, Norton LifeLock. Learn more.

If you don’t make healthcare benefit elections during Annual Enrollment (November 4 – 18), you will have NO COVERAGE for medical and prescription, dental, vision or identity theft protection benefits starting January 1, 2026. There is no default coverage. In addition, any contributions you’re currently making to a Health Savings Account or Flexible Spending Account for healthcare or dependent daycare expenses will end on December 31, 2025, unless you make a new election. It’s also important to remember that the IRS restricts changes to most benefits beyond the Annual Enrollment period, unless you experience a qualifying life event.

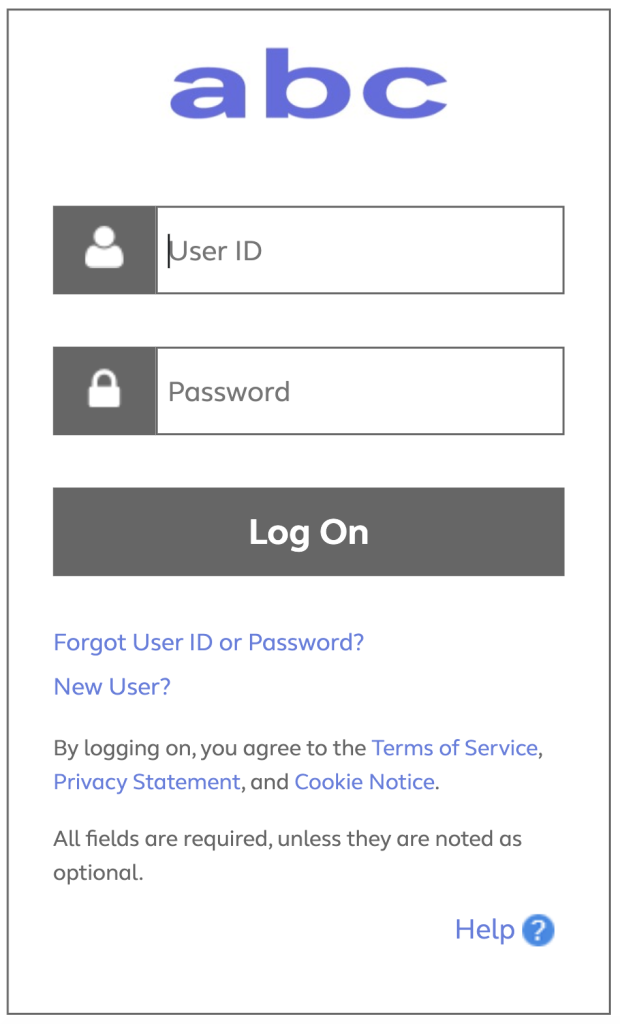

Heads up! You are leaving the ABC InfoShare. Unless you’re on the Asurion network, you’ll need your username and password to access Asurion Benefits Central at asurion.benefitsnow.com. Only current Asurion employees may log in.

If you don’t have the required log-in details, select Forgot User ID or Password? and follow the prompts. If this is your first visit to Asurion Benefits Central, click New User?

Questions: Call 844.968.6278.

Register in Asurion Learning for the meeting you’d like to attend. After registering, you’ll receive a confirmation email containing information about joining the meeting.

No events found.

Text “Benefits” to 67426 to have a link sent to your phone. Then, click the link to download the Alight Mobile app so you can access all the functions of the ABC on the go. (You’ll need to set your “Primary Phone” in Workday as your mobile number for full functionality.)