|

Standard |

Select |

Premium |

|

|---|---|---|---|

|

Note:

|

|

|

|

|

DIAGNOSTIC & PREVENTIVE SERVICES |

|||

|

Includes: Oral exams and cleanings, Problem-focused oral exams, Fluoride applications, Bitewing X-rays, Full mouth/panelipse X-rays, Sealants, Space maintainers |

100% covered |

100% covered |

100% covered |

|

BASIC SERVICES |

|||

|

Includes: Fillings, Endodontic services, Full mouth debridement, Periodontal Cleanings, Periodontic services, Simple extractions, Complex Oral surgery |

You pay 20% (coinsurance) after deductible |

You pay 20% (coinsurance) after deductible |

You pay 20% (coinsurance) after deductible |

|

MAJOR SERVICES |

|||

|

Includes: Stainless steel crowns, Denture relines – rebases and adjustments, Crowns, Prosthodontics – removable and fixed, Implants, Occlusal guard (bruxism) |

Not covered |

You pay 40% (coinsurance) after deductible |

You pay 20% (coinsurance) after deductible |

|

ORTHODONTIC SERVICES1 |

|||

|

Not covered |

|

|

|

|

You Pay |

|||

|

ANNUAL DEDUCTIBLE (Employee only | Family) |

$100 | $300 |

$100 | $300 |

$50 | $150 |

|

ANNUAL maximum coverage Per person |

$1,000 |

$1,500 |

$2,500 |

|

ORTHODONTIA LIFETIME LIMIT Excluded from annual out-of-pocket maximum |

Not covered |

$1,500 per person |

$2,000 per person |

What you’ll pay for coverage is just one consideration. Another important factor is whether you have kids, because kids often need braces and/or may have activity-related accidents that could require dental intervention. You also should think about genetics — in other words, if your parent or sibling has needed dental services, there’s a good chance you also may.

Your cost of coverage (“premiums”) are deducted from your paycheck before taxes are added. You can pay your deductible and coinsurance by:

Get a free hearing assessment and up to 68% off hearing aid options.

Consult with dentists remotely for the diagnosis and treatment of minor issues up to twice per year at no extra cost.

Extra dental cleanings and treatment delivery modifications are available to patients with special needs.

Additional benefits are available for members who are pregnant, or who have chronic conditions such as cancer, diabetes, kidney disease and other diagnoses.

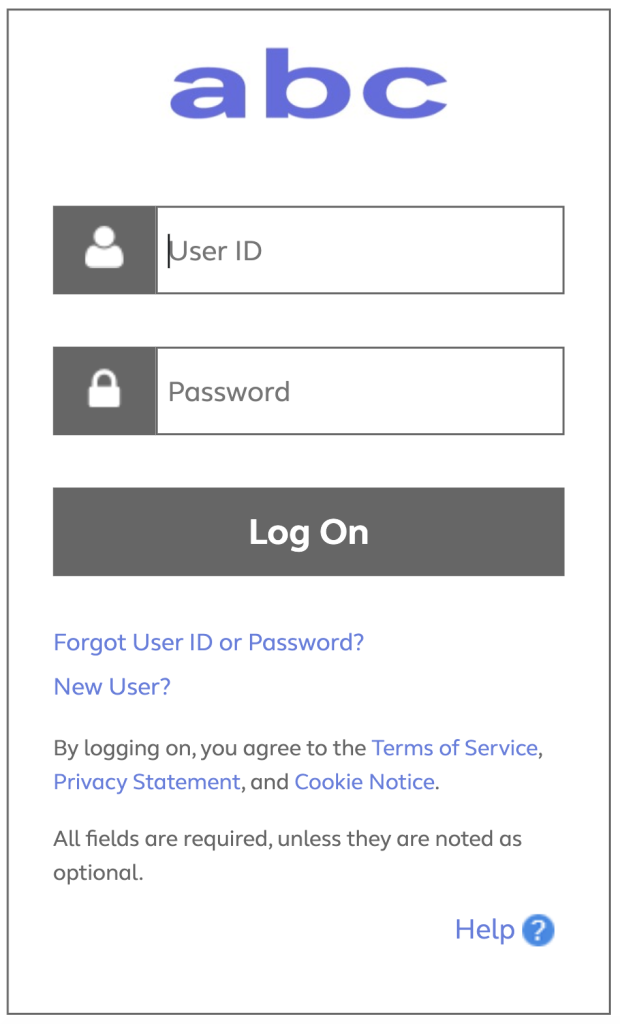

Heads up! You are leaving the ABC InfoShare. Unless you’re on the Asurion network, you’ll need your username and password to access Asurion Benefits Central at asurion.benefitsnow.com. Only current Asurion employees may log in.

If you don’t have the required log-in details, select Forgot User ID or Password? and follow the prompts. If this is your first visit to Asurion Benefits Central, click New User?

Questions: Call 844.968.6278.

Register in Asurion Learning for the meeting you’d like to attend. After registering, you’ll receive a confirmation email containing information about joining the meeting.

No events found.

Text “Benefits” to 67426 to have a link sent to your phone. Then, click the link to download the Alight Mobile app so you can access all the functions of the ABC on the go. (You’ll need to set your “Primary Phone” in Workday as your mobile number for full functionality.)